The Sources of Business Interest in Social Insurance:

Sectoral versus National Differences

Isabela Mares

World Politics, Volume 55, Number 2, January 2003, pp. 229-258 (Article)

Published by Cambridge University Press

DOI:

For additional information about this article

[ Access provided at 9 Jan 2021 00:29 GMT from Yale University Library ]

https://doi.org/10.1353/wp.2003.0012

https://muse.jhu.edu/article/41601

World Politics 55 (January 2003), 229–58

THE SOURCES OF BUSINESS

INTEREST IN SOCIAL INSURANCE

Sectoral versus National Differences

By ISABELA MARES

W

HAT factors explain the preferences of employers toward vari-

ous policies of social insurance? When and why have employers

supported the creation of policies that provide insurance benefits to

workers who experience various employment-related risks? These im-

portant questions for the political history of the modern welfare state

have been largely overlooked by political economists and social policy

scholars. Most studies on the development of systems of social protec-

tion have assumed that employers oppose the expansion of social insur-

ance. Business, it has commonly been argued, has left its imprint on the

political history of the modern welfare state by opposing the demands

of labor-based organizations or by counteracting the administrative

largesse of bureaucratic officials. The dominant research tradition on

the development of modern institutions of social insurance has charac-

terized the expansion of the welfare state as “politics against markets”—

the political triumph of labor-based organizations over a political

community of employers forced into retreat.

1

This article challenges the assumption of business opposition to

social insurance that has informed comparative research on the welfare

state. Its main objective is to develop a theory of the social policy

preferences of firms that specifies the conditions under which profit-

maximizing firms, facing competition in domestic or international

markets, nevertheless support various institutions of social insurance.

What is the importance of social policies to firms? Is the welfare state

only a constraint that imposes higher costs or unnecessary labor-market

rigidities on firms, or does it also provide employers with some direct

and tangible benefits? What precisely are the institutional advantages

social policies can offer to firms? Under what conditions do these ad-

1

Gøsta Esping-Andersen, Politics against Markets (Princeton: Princeton University Press, 1985);

Gøsta Esping-Andersen and Walter Korpi, “From Poor Relief towards Institutional Welfare States:

The Development of Scandinavian Social Policy,” in Robert Eriksson, ed., The Scandinavian Model:

Welfare States and Welfare Research (New York: Sharpe, 1985).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 229

vantages exceed the costs imposed by social policies on firms? The

analysis seeks to identify the factors affecting the cost-benefit calcula-

tions made by different firms facing the introduction of a new social

policy.

An important goal of the article is to identify the factors affecting

the variation in the social policy preferences of firms. What variables

explain the cleavages within the business community during different

episodes of social policy reform? Existing political economy research

examining the policy preferences of employers toward wage-bargaining

institutions and other labor-market policies presents two competing

hypotheses about the nature of the variation in the policy preferences

of employers. One set of studies has identified the existence of strong

cross-national variation in employers’ policy preferences.

2

Recent re-

search on the role of employers in labor-market reforms of the last two

decades finds a strong divergence in the preferences of employers in lib-

eral market economies (such as the U.K. or the U.S.) and employers in

coordinated market economies (such as Germany, Austria, the Nether-

lands, or Northern European countries). These studies suggest that

employers in the United Kingdom and the United States have em-

braced radical proposals for labor-market deregulation and the weak-

ening of the power of trade unions.

3

As Stewart Wood argues, in

“liberal market economies, employers’ preference is to weaken organ-

ized labor as much as possible. Where firms do not rely upon produc-

tion strategies that render organized labor a virtue—in collective

bargaining or managing process innovation, for example—they will see

strong trade unions and strong employment protection as fetters on

their ability to compete on the basis of lowering production costs.”

4

By

contrast, employers in Germany or other Northern European

economies have shown only lukewarm support for attempts at radical

labor market reforms and have defended a variety of non-market-based

institutions protecting labor.

5

According to Wood:

230 WORLD POLITICS

2

See Stewart Wood, “Business, Government and Patterns of Labor Market Policy in Britain and

the Federal Republic of Germany,” in Peter Hall and David Soskice, eds., Varieties of Capitalism (Ox-

ford: Oxford University Press, 2001); and Margarita Estevez-Abe,Torben Iversen, and David Soskice,

“Social Protection and the Formation of Skills,” also in Hall and Soskice.

3

Desmond King and Stewart Wood, “The Political Economy of Neoliberalism: Britain and the

United States in the 1980’s,” in Herbert Kitschelt et al., eds., Continuity and Change in Contemporary

Capitalism (Cambridge: Cambridge University Press, 1999); Robert Boyer, The Search for Labor Mar-

ket Flexibility (Oxford: Clarendon Press, 1988).

4

Wood (fn. 2), 252.

5

Philip Manow, “New Coalitions in Welfare State Reforms,” in Paul Pierson, ed., The New Politics

of the Welfare State (Oxford: Oxford University Press, 2000), 161; Kathleen Thelen,“Why German

Employers Cannot Bring Themselves to Dismantle the German Model,” in Torben Iversen et al., eds.,

Unions, Employers and Central Banks (Cambridge: Cambridge University Press, 2000).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 230

In coordinated market economies, product market, innovation and work-

organization strategies depend upon collaboration with organized labor. One

key role of public policy is therefore to maintain framework legislation that pro-

tects workers’ organizations and protects their role as partners in negotiated out-

comes. . . .This in turn gives employers incentives to participate in the provision

of the relevant supply-side collective goods and the governance structures that

make this possible.

6

Other studies have argued that the most significant variables ex-

plaining the variation in the policy preferences of firms are located at

the sectoral level. In a pioneering study that examines the role played by

employers in the centralization of the wage-bargaining system in Den-

mark and Sweden, Peter Swenson argues that large export-dependent

firms supported a highly centralized wage-bargaining system as means

of preventing sheltered producers from attracting workers by offering

higher wages.

7

However, the institutional advantages provided by the

centralized system of wage bargaining to Swedish export employers

eroded over time. Unions’ pursuit of intrafirm and intersectoral wage

leveling undermined the ability of firms to “secure an adequate supply

of motivated labor to the export sector.”

8

A strong intersectoral conflict

among Swedish employers flared up at the beginning of the 1980s, as

manufacturing employers pushed for a stronger decentralization of

wage bargaining, in an effort to secure more flexible pay structures.

Kathleen Thelen’s study of the evolution of German institutions of

wage bargaining during recent decades also points to the “activation of

a previously dormant cleavage within key employers’ associations”

9

over

the advantages of the existing institutions of wage bargaining. While

large manufacturing employers are “unwilling to abandon the German

model,” due to the high vulnerability of firms to overt labor conflict,

Thelen finds that Germany’s small and medium-size firms of the Mit-

telstand have “been growingly disgruntled” with the architecture of the

German wage-bargaining system.

10

This article develops and tests a model of the policy preferences of

firms toward different policies of social insurance. It examines the most

important calculations faced by employers during the development of a

new social policy and specifies the factors that explain the variation in

BUSINESS INTEREST/SOCIAL INSURANCE 231

6

Wood (fn. 2), 252.

7

Swenson, “Bringing Capital Back In, or Social Democracy Reconsidered: Employer Power, Cross-

Class Alliances, and the Centralization of Industrial Relations in Denmark and Sweden,” World Poli-

tics 43 ( July 1991).

8

Jonas Pontusson and Peter Swenson, “Labor Markets, Production Strategies and Wage Bargaining

Institutions,” Comparative Political Studies 29 (April 1996), 232.

9

Thelen, “Varieties of Labor Politics,” in Hall and Soskice (fn. 2), 83.

10

Ibid., 84.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 231

firms’ social policy preferences. What is the relative importance of

national-level versus sectoral variables in predicting the social policy

demands of firms? To explore these questions, the remainder of the ar-

ticle is organized as follows. I begin by presenting the most salient

questions of policy design confronted by employers during the intro-

duction of a new social policy. Next I formulate a series of hypotheses

about the variables affecting employer preferences. These explanations

are tested by examining the demands of French and German employers

during three episodes of social policy development: the introduction of

compulsory accident insurance (during the 1880s–90s), the develop-

ment of unemployment insurance (during the 1920s), and the reorga-

nization of social insurance during the first years of the postwar period

(1945–48).

T

HE S

OCIAL POLICY

SPACE

Social insurance policies come in a variety of institutional forms. Some

policies are organized by private actors, such as trade unions, mutual aid

societies, firms, or associations of producers. Other policies are admin-

istered exclusively by the state. Some policies have narrow pools of ben-

eficiaries. In other cases, the entire population is eligible for benefits.

Some policies provide meager benefits and are characterized by strin-

gent eligibility conditions. In other cases, social policies replace most,

if not all, the income lost by the worker because of employment-related

risks, such as sickness or disability.

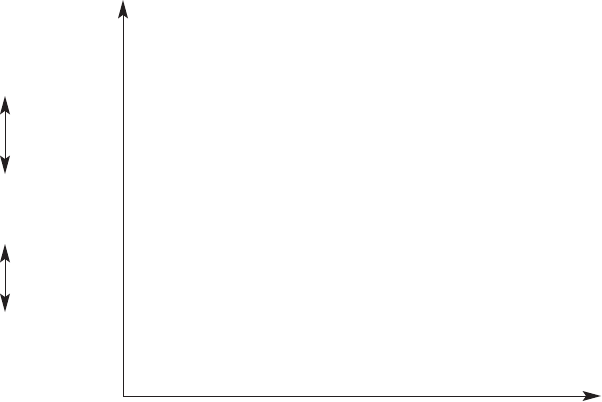

A set of simplifications is necessary to guide us through this thick in-

stitutional terrain. I begin by assuming that existing social policies can

be represented in a two-dimensional social policy space. Social policy is

defined broadly to include both private and publicly financed social in-

surance. The two axes of the social policy space represent the two ques-

tions of policy design that were politically most contested in the history

of the welfare state: (1) the scope of social insurance coverage and (2)

the distribution of responsibility for the administration of social insur-

ance. The percentage of the population that has access to social policy

benefits varies considerably over time, across countries, and, within the

same country, across different labor-market risks. As Peter Baldwin re-

minds us, only some welfare states “went from Bismarck to Beveridge.

. . . Insurance has existed for millennia, social insurance developed in

response to the widespread and multiple uncertainties attendant on

modern economies, while the solidaristic welfare state of a Marshallian

kind has been the exclusive preserve of only a few nations at certain

232 WORLD POLITICS

v55.2.228.mares.cx 3/17/03 1:53 PM Page 232

times in the twentieth century.”

11

A few examples can illustrate the

wide variation in the scope of social insurance coverage. At the turn of

the twentieth century, after a first wave of social policy reforms pio-

neered by the Bismarckian legislation, the percentage of the labor force

entitled to social policy benefits in case of occupational injuries was as

high as 71 percent in Germany, 39 percent in Britain, and about 15

percent in Austria, Denmark, Norway, and Switzerland.

12

At the onset

of the Great Depression the percentage of the workforce eligible for

unemployment benefits was 58 percent in the United Kingdom, 44

percent in Germany, 34 percent in Austria, and about 20 percent in

Belgium, Denmark, Italy, and Switzerland.

13

The horizontal axis of the social policy space represented in Figure 1

is labeled risk redistribution. This dimension captures both the existing

variety in the scope of social insurance and the diversity in the modes

by which social policies reapportion the incidence and costs of various

risks among labor-market participants. The positioning of various so-

cial policies along this horizontal axis results from a combination of de-

cisions concerning two interrelated questions of policy design. The first

concerns the size of social insurance coverage. How wide is the level of

coverage and who is eligible for benefits? Is social policy restricted to

the participants of a single firm? Is social insurance mandatory for the

entire population of a country—or are certain groups and occupations

ineligible for social policy benefits? Second, the degree of risk redistri-

bution of a social policy is influenced by additional policy decisions that

determine the relationship between the incidence of a risk and the level

of social insurance contributions. Are social insurance contributions

calculated solely on the basis of actuarial principles? The degree of risk

redistribution of a social policy is lower if social insurance contributions

are tightly coupled to the incidence of a risk; it is higher in the case of

social policies that loosen this relationship.

The second, separate question of policy design concerns the distri-

bution of responsibilities in the administration of social insurance

among bureaucratic representatives, on the one hand, and unions and

employers, on the other hand. In 1908 the main publication of the

Central Federation of German Trade Unions referred to these “admin-

istrative questions (Verwaltungsfragen)” as the “key element in the de-

BUSINESS INTEREST/SOCIAL INSURANCE 233

11

Baldwin, The Politics of Social Solidarity: Class Bases of the European Welfare State, 1875– 1975

(Cambridge: Cambridge University Press, 1990), 5.

12

Peter Flora and Jens Alber, State, Economy and Society in Western Europe (Frankfurt: Campus,

1983), 460.

13

Ibid., 461.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 233

sign of social insurance.”

14

This issue has been one of the most divisive

political questions throughout the history of welfare state development.

Consequently, social policies vary tremendously in the adopted insti-

tutional solutions. In some cases—such as Ghent policies of unemploy-

ment insurance—the entire responsibility for administering un-

employment benefits rests with the trade unions. Means-tested policies

of social assistance or universalistic social policies are administered by

state bureaucrats, with no participation of trade union or employer rep-

resentatives. Contributory social insurance policies or occupation-based

social policies can be administered in a “corporatist” fashion by trade

union and employers’ associations (with or without involvement of the

state). Finally, some social policies can be administered by individual

firms. This is the case of “private” social policies—such as pensions,

sickness, or housing policies.

I label the vertical axis of the social policy space control. We can think

of control as authority over policy decisions concerning the determina-

tion of the level of insurance contributions and benefits, adjustments in

the financing of social policy in response to the expansion or contrac-

234 WORLD POLITICS

14

Allgemeiner Deutscher Gewerkschaftsbund, Correspondenzblatt der Generalkommission der

Gewerkschaften Deutschlands (Berlin: Legion, December 1902), 308.

Firms’ Control

High Level of

Firm Discretion

firm-level social policies

occupational-based

social policies

Collective Control

of Employers’

Associations contributory

insurance

No Involvement of

Employers in the union-administered universalistic

Administration of social policies social policies

Social Insurance

Risk Redistribution

FIGURE 1

T

HE SOCIAL POLICY SPACE

v55.2.228.mares.cx 3/17/03 1:53 PM Page 234

tion of the contributory base of social insurance, the modification of

administrative criteria defining the entitlement for social policy bene-

fits, and so on. Without any loss of generality, we can recode this axis as

measuring responsibilities in the administration of social insurance re-

tained by one of these three actors. The vertical axis in Figure 1 repre-

sents the residual responsibilities in the administration of social

insurance retained by individual firms. Private social policies are found

at one extreme of this axis. In these cases, individual firms can retain

unlimited discretion over all policy decisions. In the case of policies tak-

ing intermediate values along this dimension, associations of employ-

ers administer social policies together with trade unions. This principle

of the corporatist organization of social insurance was pioneered dur-

ing the early social policy reforms in Germany during the 1880s and

adopted by a large number of countries in the design of their insurance

systems. Finally, in social policies that take extremely low values along

this dimension of the social policy space, employers are entirely absent

from the administration of social insurance. The most significant policy

decisions remain in the hands of either trade unions or government

officials.

In Figure 1 a variety of social policies are positioned within the pol-

icy space bounded by the two axes: risk redistribution and control. At

one extreme we find universalistic social policies that take high values

on the risk redistribution axis and low values on the control dimension

of the social policy space. The entire population is entitled to social pol-

icy benefits, guaranteeing de facto that the “community of risks coin-

cides with the entire human community.”

15

Neither individual firms nor

business associations play a role in the administration of social policies.

Consequently, these policies take zero values along the control axis of

the social policy space. At the other extreme of the social policy space,

we find private social policies. Social insurance coverage is restricted to

the employees of the particular firm. In these cases the firm retains a

high level of discretion in targeting these benefits at the highly skilled

or the highly productive workers or in withholding these benefits from

employees considered to be less productive. Thus, the administrative

discretion retained by the firm is maximal.

Various contributory insurance policies can be situated along a line

linking private-type social policies to universalistic social policies. In

contrast to private social policies, employers’ associations (and not indi-

vidual firms) participate in the administration of the particular social

BUSINESS INTEREST/SOCIAL INSURANCE 235

15

Baldwin (fn. 11), 3.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 235

policy.

16

Some contributory insurance policies can be very close to the

universalistic pole of the social policy space. In this case employers’ as-

sociations retain only a very limited (and sometimes only symbolic) role

in the administration of the social policy. The level of risk redistribu-

tion of this policy can be very high, if social insurance contributions are

uniform across occupations and not linked to the incidence of the risk

affecting the particular occupation and if the level of social insurance

coverage is very broad. Conversely, we find contributory insurance poli-

cies that are closer to private-type social policies. In this case social in-

surance coverage is more limited in scope and a variety of occupations

do not have access to social policy benefits. The social insurance con-

tributions are linked to the incidence of a risk and we find no redistri-

bution of risks across occupations.

Two additional observations about Figure 1 are necessary. First, so-

cial policies taking simultaneously high values along both axes, risk re-

distribution and control, do not exist. A hypothetical example of a

policy situated in the upper-right-hand corner of the policy space

would be a social policy that is entirely administered by a firm with no

participation of labor representatives or the state but that remains uni-

versalistic in character. Such policies remain historically unknown. Sec-

ond, the diagonal axis in Figure 1—linking private social policies to

contributory insurance and universalistic social policies—points to a

policy trade-off between risk redistribution and control. When con-

fronted with the introduction of a new social policy, employers are

never able to achieve a maximal level of risk redistribution and control

at the same time. Policies in which firms’ control is maximal (private

social policies) are ultimately incompatible with a very high level of risk

redistribution. Conversely, in policies characterized by a high level of

risk redistribution (universalistic social policies), control is very low. In

examining the social policy preferences of employers, we need to ex-

plore the conditions under which different firms prefer different com-

binations of risk redistribution and control.

236 WORLD POLITICS

16

The importance of employers’ associations in the administration of contributory insurance policies

varies tremendously across policies. For example, the Bismarckian reforms, which pioneered the prin-

ciple of a “corporatist” administration of social insurance, gave employers’ representatives one-half of

the number of seats in the institutions administering old-age insurance and one-third of the seats in

the supervisory councils of sickness insurance. By contrast, accident insurance was administered en-

tirely by employers’ associations, with no involvement of trade union representatives or the state. A po-

tential conflict can emerge between employers’ associations (preferring collective control) and large

firms (who favor firm-level control). How this conflict is resolved depends on (1) the sanctioning in-

struments of the associations and (2) the importance of social policy to the firm. Thus, in the case of

disability insurance, the introduction of compulsory insurance largely ended private social policies. By

contrast, in the case of early retirement policies, employers’ associations were not able to stop the

process of firm-level early retirement.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 236

THE

S

OCIAL POLICY

PREFERENCES OF EMPLOYERS

We now turn to the question of business preferences toward different

institutions of social insurance. Under what conditions do profit-

maximizing firms, facing competition in domestic or international mar-

kets, nevertheless support the adoption of various policies of so-

cial insurance? What institutional benefits do employees obtain from

social policy? The starting point of my analysis is the observation that

social policies mitigate the reluctance of workers to invest in skills. To

invest in skills, a worker needs income protection for when the em-

ployment relationship is temporarily interrupted, such as periods of

sickness, disability, or unemployment. It is rational for employers to

commit resources to policies of social protection to induce workers to

make these investments in skills. Policies of social insurance with earn-

ings-related benefits that replace a significant part of the income lost by

the workers provide these institutional guarantees and give workers in-

centives to undertake these risky investments in skills. Thus, a social

policy that insures workers for employment-related risks also protects

the investment made by employers in the skills of their workers.

This hypothesis suggests that the benefits provided by social policies

to employers can outweigh the costs imposed by social policies on

firms, if the firm wants workers to invest in skills. But what are the im-

plications for the social policy preferences of firms? When will firms

prefer more private-type social policies and when will they prefer more

redistributive social policies? What are the most significant factors af-

fecting the utility of firms along the two dimensions of the social policy

space outlined in the previous section? To answer these questions, I ex-

amine the calculations made by firms confronted with a choice of dif-

ferent social policies.

As discussed above, the vertical axis of the social policy space mea-

sures the residual responsibilities in the administrative control of social

insurance retained by a firm. What are the costs for an individual firm

associated with an upward movement along this axis? An increase in

the level of control retained by employers in the administration of social

insurance increases firms’ share in the financing of the social policy.

Universalistic social policies are generally financed by income taxes and

thus affect employers only indirectly, via their impact on the general

price level of the economy. By contrast, contributory insurance policies

are financed by payroll taxes. Generally, the distribution of the tax bur-

den among employers and employees is proportional to the responsi-

bilities of these actors in the administration of the particular branch of

social insurance. Finally, private social policies can be financed by a

BUSINESS INTEREST/SOCIAL INSURANCE 237

v55.2.228.mares.cx 3/17/03 1:53 PM Page 237

combination of contributions from employers and employees or by em-

ployers’ contributions alone. Thus, private social policies or contribu-

tory insurance solutions can be costlier to firms than universalistic or

means-tested social policies.

What benefits do employers derive from an increased involvement

in the administration of social insurance? The most obvious institu-

tional advantage is an increase in their discretion in important social

policy decisions. Social policies can become an important instrument

complementing the employment practices of firms. Firms gain addi-

tional flexibility to rely on social policies both during periods of labor-

market shortages and during periods of unemployment. Policies taking

high values along the control dimension of the social policy space—pri-

vate social policies or contributory insurance—provide a second distinct

institutional advantage to employers. This derives from the tight cou-

pling between the social insurance benefits and the wage-hierarchy es-

tablished within the firm. Earnings-related social policy benefits raise

the relative reservation wage of high-skilled workers (relative to low-

skilled workers), lowering the incentives of these workers to take up

jobs that do not correspond to their skill qualifications. By mitigating

the incentives of high-skilled workers to take up jobs that do not corre-

spond to their skill qualifications, these policy instruments provide in-

direct institutional guarantees to employers that their investment in

skills will not be undermined during periods in which workers are tem-

porarily out of work. Third, firms may seek higher levels of control in

the administration of social insurance to counteract a potential increase

in the institutional prerogatives of trade unions and to shift the balance

of political power away from organized labor. During the imperial pe-

riod the peak federation of German employers’ associations (Vereini-

gung der Deutschen Arbeitgeberverbände) referred to the Ghent

policy of unemployment assistance as a “hidden subsidization of the

strike funds of trade unions [verkappte Streikunterstützung]” and

strongly opposed social policies that gave unions a role in the adminis-

tration of social policy benefits.

17

During the first years of the postwar

period, employers in many countries strongly opposed policy proposals

that increased the representation of labor in the administration of social

238 WORLD POLITICS

17

“Von der Arbeitslosenversicherung,” Der Arbeitgeber, December 1, 1913. For similar considera-

tions, see also “Das Problem der Arbeitslosenversicherung,” Der Arbeitgeber, January 1, 1910; Vereini-

gung der Deutschen Arbeitgeberverbände, Geschäftsbericht der Vereinigung der Deutschen Arbeit-

geberverbände (Berlin: VDA 1927), 160. It is important to point out, however, that employers have not

always opposed policies with no control on the part of firms, such as Ghent policies. On small firms’

support for Ghent policies, see Isabela Mares, “Strategic Alliances and Social Policy Reform: Unem-

ployment Insurance in Comparative Perspective,” Politics and Society 28, no. 2 (2000).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 238

insurance. This suggests that employers’ motivation to support contrib-

utory social insurance policies may be stronger in economies that have

strong, well-organized trade unions.

This suggests that the utility of the firms along the vertical dimen-

sion of the social policy space can have both a positive and a negative

sign, depending on the relative magnitude of the benefits and the costs

of control to a firm. What factors influence the cost calculations made

by firms? A first variable that is likely to affect the relative importance

of these policy instruments to the firm is the firm’s skill profile. A nat-

ural hypothesis is that the presence of skilled workers within the firm

increases the importance of those policy features that protect the in-

vestment in skills. It is likely that employers who have invested signifi-

cant resources in the skills of their workers will favor social policies that

allow them to target benefits to a select group of workers and reward

their job performance. A second variable that will likely affect the cost-

benefit calculations made by firms is the size of the firm. A number of

empirical studies have suggested that firm size is a strong predictor of

the degree of market power.

18

Thus, assuming a higher market power

of large firms, we can hypothesize that these producers will have a

greater capacity than small producers to shift an increase in their non-

wage labor costs onto consumers in the form of higher prices.

19

This se-

verely constrains the ability of small firms to invest resources in the

creation of social policy programs. Because of these financial con-

straints, small firms are more likely to discount the potential institu-

tional advantages of many institutions of social insurance and to focus

instead on the financial burden of these policies. By contrast, we expect

large firms to discount more readily the adverse effects of an increase in

the level of payroll taxes.

20

BUSINESS INTEREST/SOCIAL INSURANCE 239

18

In other words, monopolistic behavior is more likely in industries where the average firm size is

higher. See Dennis Carlton and Jeffrey Perloff, Modern Industrial Organization (New York: Harper

Collins 1994), 187–88. This assumption might not be fulfilled, however, during early historical periods,

when markets were not fully integrated and when small firms enjoyed a near monopoly in local mar-

kets. Two factors that work against the effects of the fragmentation of the product markets during the

early period of industrialization are (1) the presence of economies of scale (in some industries such as

steel and railroads) and (2) the existence of cartel-type agreements among large producers.These factors

increase the degree of market power of large firms despite the fragmentation of product markets. Begin-

ning in the 1880s in both France and Germany, cartel-like arrangements were pervasive in industries

such as iron and steel or railroads. See, for example, Karl Brandt, “Konzentration und wirtschaftliche

Entwicklung,” in Helmut Arndt, ed., Die Konzentration in der Wirtschaft (Berlin: Duncker and Hum-

blot, 1971); Wolfram Fischer and Peter Czada, “Wandlungen in der Deutschen Industriestrukture im

20. Jahrhundert,” in Gerhard Ritter, ed., Entstehung und Wandel der modernen Gesellschaft (Berlin:

Gruyter, 1970), 146–49; Jacques Houssiaux, Le pouvoir du monopole (Paris: Sirey, 1978).

19

This is a standard comparative statics result in a Cournot model of competition; see Carlton and

Perloff (fn. 18), 233–34.

20

Other studies have suggested additional reasons why large firms are more likely than small pro-

ducers to support the introduction of social policies. In a study of the social policy preferences of

v55.2.228.mares.cx 3/17/03 1:53 PM Page 239

The empirical implication of the above discussion is that large firms

employing skilled workers will favor social policies characterized by

higher levels of control, while small firms employing low-skilled work-

ers will discount the potential institutional advantages of control. The

analysis does not generate unambiguous predictions for small firms em-

ploying skilled workers and large firms whose workforce consists pre-

ponderantly of low-skilled workers. I predict, however, that these firms

will experience very strong policy dilemmas and a strong tension be-

tween the potential institutional advantages of social policies and the

costs of social insurance. Hence, one would likely see greater variability

in the preferences of these firms. Characteristic examples are the small,

highly skill-intensive Handwerk firms in Germany. As the empirical

analysis will demonstrate, on some occasions these firms have sup-

ported social policies characterized by high levels of control. On other

occasions, these firms have opposed the introduction of such policies,

fearing an increase in their nonwage labor costs. During the last

decades of the nineteenth century, Handwerk firms strongly opposed

the introduction of the compulsory social insurance. However, during

the first years of the postwar period these firms have supported the Bis-

marckian policy status quo and opposed proposals to reduce the role of

employers in the administration of social insurance.

How does the utility of firms vary along the risk redistribution di-

mension of the social policy space? How do employers choose among

different social policies characterized by similar levels of control but

different levels of risk redistribution? What variables influence their

preferences? As discussed above, a movement along the horizontal di-

mension of the social policy space from private to universalistic social

policies involves an expansion of the risk pool of social insurance and a

weakening of the insurance principle in the determination of the levels

of contributions. In policies that take high values along this axis, the

determination of the level of insurance contributions is not based on

actuarial criteria alone. Thus, to characterize the preferences of em-

ployers along this dimension of the social policy space, we need to spec-

ify the relative magnitude of two separate effects, the setup costs of a

social policy versus the benefits associated with participating in a

broader pool of risks.

240 WORLD POLITICS

American employers regarding the Clinton health care plan, Cathie Jo Martin found that “large firms

are more likely to develop a supportive position on health reform. Size matters because larger firms

may be more willing to avoid labor strife. Larger companies are more likely to have economies of scale

in political action”; Martin, “Nature or Nurture? Sources of Firm Preference for National Health Re-

form,” American Political Science Review 89 (December 1995), 900.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 240

I hypothesize that employer preferences on these questions of policy

design will be influenced by relative incidence of the risks affecting

their workforce. The relative incidence of a risk can be measured as the

difference between the incidence of a risk facing a firm’s workforce and

the average at the level of the economy. I hypothesize that an increase

in the relative incidence of a risk will potentially increase the benefits

of participating in a common pool of risks. For these firms, private

forms of insurance are often ineffective, since sharing “good” and “bad”

risks is rarely possible in these narrow risk pools. By contrast, for em-

ployers facing a low incidence of risks, social policies characterized by

high levels of risk redistribution will be unattractive, since these poli-

cies turn these firms into subsidizers of high-risk industries. These

propositions have specific implications for the details of social policy

design favored by different producers. We expect low-risk producers to

favor occupational social policies or contributory social insurance poli-

cies in which the social insurance contributions of employers are deter-

mined on the basis of strict actuarial considerations, thus, social policies

that involve no redistribution of risks across occupations. In contrast,

we expect high-risk producers to favor social insurance policies charac-

terized by a high redistribution of risks. These are contributory insur-

ance policies in which the level of insurance contributions is not linked

to the incidence of a risk or universalistic social policies.

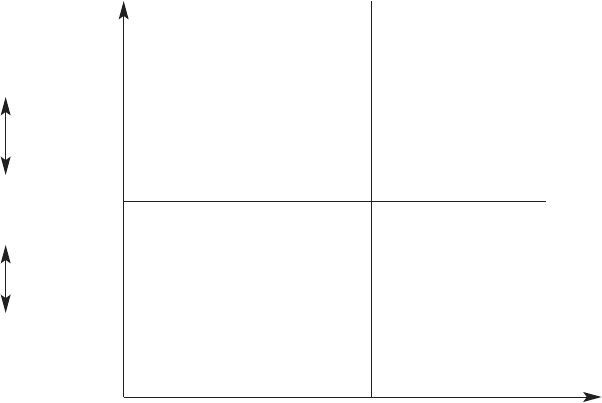

The analysis so far has identified a number of independent variables

affecting the utility of firms along the two dimensions of the social pol-

icy space. It predicts the emergence of significant intersectoral conflict

among employers during the introduction of a new social policy. I have

hypothesized that the size and skill intensity of a firm will increase the

relative benefits of social policies characterized by high levels of con-

trol. Large firms employing high-skilled workers are hypothesized to

favor social policies characterized by high levels of control. By contrast,

small firms that have not invested significant resources in the training

of the workforce will find the institutional advantages of social policies

characterized by high levels of control to be less attractive. The model

does not generate unambiguous predictions for the cases of large firms

with a low-skill workforce and small firms with a high-skill workforce.

We expect a high variability in the social policy preferences of these

firms. I have also hypothesized that an increase in the risk incidence

will increase the benefits of risk redistribution for a firm. Figure 2 sum-

marizes these hypotheses about the utility of firms.

An alternative explanation locates the most important source of vari-

ation in the social policy preferences of employers at the national level.

BUSINESS INTEREST/SOCIAL INSURANCE 241

v55.2.228.mares.cx 3/17/03 1:53 PM Page 241

Recent studies of varieties of capitalism have implications for firm pref-

erences about institutions of social insurance. According to these stud-

ies, in economies with weak business organizations (such as the U.S.,

the U.K., or France) employers are unable to solve a broad range of col-

lective action problems in the provision of skills and do not invest sig-

nificant resources in training their workers. By contrast, in economies

characterized by a dense network of institutions of business coordina-

tion (such as Germany or the Scandinavian countries), employers in-

vest significantly larger resources in the training and skill formation of

their workers. Varieties of capitalism studies hypothesize that employ-

ers in coordinated market economies are likely to support policies of so-

cial protection, because such policies mitigate the reluctance of workers

to invest in nontransferable, firm-specific skills, which can be rendered

obsolete by technological shocks.

21

As Estevez-Abe, Iversen, and Sos-

242 WORLD POLITICS

21

For a formulation of these hypotheses, see Peter Hall and David Soskice, “An Introduction to Va-

rieties of Capitalism,” in Hall and Soskice (fn. 2); Estevez-Abe, Iversen, and Soskice (fn. 2).

Firms’ Control

High Level of

Firm Discretion

firm-level social policies

occupational-based

social policies contributory

Collective Control insurance

of Employers’

Associations

No Involvement of

Employers in the union-administered universalistic

Administration of social policies social policies

Social Insurance

Risk Redistribution

FIGURE 2

P

REDICTIONS ABOUT

SOCIAL POLICY PREFERENCES OF FIRMS

Large/

High

Size

or

Skill

Intensity

Low High

Incidence of Risk

Small/

Low

v55.2.228.mares.cx 3/17/03 1:53 PM Page 242

kice argue: “If firms want to be competitive in product markets that re-

quire an abundance of specific skills, workers must be willing to acquire

these skills at the cost of increasing their dependence on a particular

employer or group of employers. Because investment in these specific

skills increases workers’ exposure to risks, only by insuring against such

risks can firms satisfy their need for specific skills.”

22

The implication

of these hypotheses is that employers in coordinated market economies

will support policies of social protection, while employers in noncoor-

dinated market economies will oppose them.

23

AN

EMPIRICAL

TEST:WHAT

FACTORS EXPLAIN THE POLICY

PREFERENCES OF FIRMS?

The theoretical implications of the model outlined in the previous sec-

tion will now be tested using the following research strategy. In an ef-

fort to increase variation along the crucial independent variables, I have

selected Germany and France as country-cases.

24

Historically, the Ger-

man and French economies have differed strongly in their industrial

structure and in the mix of large and small firms. Until the wave of

modernization that began in the late 1950s, the French economy had

been dominated by agricultural small producers.

25

For example, in

1896, 72 percent of all French employers were agricultural employers;

in 1921, the ratio was 78 percent.

26

In France agriculture represented

44.8 percent of the labor force in 1896 and 41.54 percent in 1921, re-

spectively. According to data collected by French labor-market author-

ities, in the late nineteenth century more than 60 percent of the French

labor force was employed in enterprises with fewer than ten employ-

ees.

27

In 1921, 97 percent of French agricultural employers employed

fewer than five workers, a figure that remained virtually unchanged in

BUSINESS INTEREST/SOCIAL INSURANCE 243

22

Estevez-Abe, Iversen, and Soskice (fn. 2), 181.

23

Wood (fn. 2).

24

See Gary King, Robert Keohane, and Sidney Verba, Designing Social Inquiry: Scientific Inference in

Qualitative Research (Princeton: Princeton University Press, 1994), 137. France and Germany are also

examples of coordinated and uncoordinated market economies, respectively. As numerous historians

of the development of the German political economy have pointed out, the defining institutional char-

acteristics of a coordinated market economy were already in place in the mid-1880s. These included

(1) provision of “patient finance” by large banks and (2) strong and encompassing business associations.

See, for example, Volker Hentschel, Wirtschaft und Wirtschaftspolitik im wilhelminischen Deutschland:

Organisierter Kapitalismus und Interventionsstaat (Stuttgart: Klett-Cotta, 1978); Hans-Peter Ullmann,

Interessenverbände in Deutschland (Frankfurt: Suhrkamp, 1983).

25

See, for example, Patrick Fridenson and André Straus, Le Capitalisme français au XIX–XX

ième

siè-

cle (Paris: Fayard, 1987); Denis Woronoff, Histoire de l’industrie en France (Paris: Seuil, 1994).

26

Flora and Alber (fn. 12), 497, 501.

27

République Française, Journal Officiel (Sénat), March 12, 1889, 200.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 243

1931.

28

By contrast, in Germany at the turn of the century about 40

percent of the workforce was employed in enterprises with fewer than

ten workers; the number declined to 30 percent in 1925 and to 26 per-

cent in 1950.

29

Historically, Germany and France have also exhibited a

strong variation in the skill profile of their workforce. Legislation fos-

tering vocational training goes back in Germany to the 1860s and

1870s.

30

Building on these earlier policies, an important law of 1897

“created a network of handicraft chambers (Handwerkskammern) en-

dowed with extensive powers to regulate the content and quality of

craft apprenticeships.”

31

During the same period large German firms

developed firm-level vocational schools (private Fachschulen) that re-

sponded to their demands for a high-skilled workforce.

32

Based on

some estimates, the percentage of skilled workers exceeded 50 percent

of the workforce in some industries (such as metalworking and metal

processing).

33

By contrast, France did not have comparable legislation

fostering the development of institutions of skill formation.

34

Large

French firms in “modern” industries—such as metallurgy and chemi-

cals—drew on the large reservoir of unskilled immigrant workers and

did not develop extensive internal policies of vocational training.

35

The sources for the analysis of the social policy preferences of firms

are the minutes of the deliberations of employers’ associations, various

periodicals of employers’ associations, and statements and documents

submitted by employers’ associations to various bureaucratic and par-

liamentary commissions. The dataset used here is drawn from unpub-

244 WORLD POLITICS

28

Albert Broder, Histoire économique de la France au XX

ème

siècle (Paris: Ophrys, 1998), 46.

29

Walther Hoffmann. Das Wachstum der Deutschen Wirtschaft seit der Mitte des 19. Jahrhunderts

(Berlin: Springer, 1965), 212.

30

See Hans Pohl, Berufliche Aus- und Weiterbildung in der deutschen Wirtschaft seit dem 19. Jahrhundert

(Wiesbaden: Steiner, 1979).

31

Kathleen Thelen and Ikuo Kume, “The Rise of Nonmarket Training Regimes: Germany and

Japan Compared,” Journal of Japanese Studies 25 ( January 1999), 39.

32

See Gerhard Adelmann, “Die Berufliche Ausbildung und Weiterbildung in der Deutschen

Wirtschaft, 1871–1918,” in Pohl (fn. 30), 21.

33

Ibid., 23.

34

See Patrice Pelpel and Vincent Troger, Histoire de l’enseignement technique (Paris: Hachette, 1993).

For postwar developments, see Lucie Tanguy, “Les promoteurs de la formation en enterprise,

1945–1971,” Travail et emploi 86 (April 2001).

35

See Gary Cross, Immigrant Workers in Industrial France: The Making of a New Laboring Class

(Philadelphia: Temple University Press, 1983); and Gérard Noiriel, Workers in French Society in the

Nineteenth and Twentieth Centuries (Oxford: Berg, 1990). According to statistics reported in Cross, in

1906, 17.6 percent of the workforce in metallurgy and 10 percent of the workforce in the chemical in-

dustry were foreign workers (p. 23). As Noiriel pointed out: “The dependence on very large-scale im-

migration during the 1920s became one of the primary sociological factors underlying the boom in

French industry during those years. Immigrant workers were, moreover, most numerous in the most

dynamic sectors with the greatest profits” (p. 123). During the interwar period “the proportion of im-

migrant workers in heavy metal-industry rose to 38.2 percent (in 1931). In the mines, immigrant

workers represented 6.5 percent of the labor force in 1906 and 42 percent in 1931” (p. 121).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 244

lished documents found in the main business and parliamentary archives

in France and Germany.

36

The sample for each policy episode consists

of representative sectors of the business community of the period,

37

in-

cluding, on the one hand, the most significant federations of employers

(such as the Union of Metallurgical and Mining Industries in France

and the Central Federation of German Employers’ Association in Ger-

many) and of associations representing small firms (the Federation of the

German Handwerk, various chambers of commerce), on the other hand.

The theoretical model outlined in the previous section has two main

observable implications. First, the model predicts that firm size and the

skill profile of the firm will influence the policy preferences of firms

about the administrative design of social policies. Second, the model

predicts that the incidence of risk will predict firms’ preferences along

the risk-redistribution dimension of the social policy space. An alter-

native explanation suggests that the cross-national variation among

French and German employers should override possible intersectoral

differences. The main implication of the varieties of capitalism litera-

ture is that employers in a coordinated market economy (Germany)

should support policies of social insurance. French employers, by con-

trast, are expected to oppose social policies.

T

HE DEVELOPMENT OF ACCIDENT INSURANCE

Reform of legislation compensating victims of workplace accidents was

a significant issue on the policy agenda of most industrializing coun-

tries during the last three decades of the nineteenth century. After the

failure of attempts to confine reforms to an incremental change in lia-

bility laws, more ambitious proposals that attempted to introduce so-

cial insurance moved to the center of the policy agenda. However, issues

related to the design of institutions of social insurance raised difficult,

nearly intractable dilemmas of policy design. What should be the relative

BUSINESS INTEREST/SOCIAL INSURANCE 245

36

This dataset is based on documents found at the following archives: the Economic Archive of

Rheinland-Westfalen (Cologne), the State-archive Dahlem (Berlin), the Federal Archive (Potsdam

and Koblenz), the Archive of the Central Federation of German Employers’ Association (Cologne).

The archival sources in France are the National Archives, the Archive of the Paris Chamber of Com-

merce (which hosts the archive of the Assembly of Presidents of French Chambers of Commerce), the

Archive of the Commission de Représentation Patronale and the Center of Contemporary Archives.

37

I analyze the policy preferences of employers in the development of accident, unemployment, and

old-age insurance. I have selected these policies to maximize variation in the types of policy trade-offs

faced by firms during the introduction of a new social policy. In the cases analyzed below, the set of

policy alternatives that are on the agenda of policymakers include policies of social insurance organized

by trade unions (in the case of unemployment insurance), private, voluntary insurance (in the case of

workplace accidents), and universalistic social policies (in the case of old-age insurance during the

postwar period).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 245

role of the state and private actors in the administration of these poli-

cies? Should social insurance be mandatory for all industries or only for

the mechanical industries facing a high incidence of workplace accidents?

Questions concerning the proper mix between institutions of social

insurance administered by the state and “private-type” social policies

administered by individual firms or associations of producers were dis-

tributionally divisive for employers. In both France and Germany large

manufacturing employers preferred a policy outcome that guaranteed

the autonomy of preexisting private institutions of social insurance. In

both societies large firms or sectoral or regional associations of produc-

ers had established private-type policies providing benefits to the vic-

tims of workplace accidents. In France the largest institution

compensating victims of workplace accidents had been established by

the Iron Works Committee (Comité des Forges) and included thirty-

one firms.

38

Faced with proposals to create social insurance, these pro-

ducers advocated a social policy that guaranteed the autonomy of the

policies established by employers.

39

In Germany the leading peak asso-

ciation representing large manufacturing producers, the Federation of

German Industrialists, opposed the monopolization of social insurance

by the state. This solution was characterized as “an unnecessary form of

state socialism, given the dense network of preexisting institutions of

social insurance existing in German society.”

40

The Federation of Ger-

man Industrialists preferred a corporatist organization of social insur-

ance that entrusted significant administrative responsibilities to

associations of employers.

41

Thus, large manufacturing producers attached high importance to

the participation of employers in the administration of social insurance.

In exchange for higher control, these employers were prepared to ac-

cept higher social insurance contributions. Small firms had the oppo-

site policy priority. The main consideration of these employers was the

reduction in their nonwage labor costs. A survey carried out by the

Prussian Statistical Office among sixty-one chambers of commerce

found only five of them voicing concern about the absence of represen-

tation of employers in the new institutions of social insurance.

42

More

246 WORLD POLITICS

38

“L’assurance libre contre les accidents du travail,” La Réforme Sociale, June 16, 1893, 961.

39

See “L’assurance obligatoire allemande et l’assurance libre,” La Réforme Sociale, March 1, 1894,

345.

40

Verhandlungen, Mitteilungen und Berichte des Centralverbandes Deutscher Industrieller, no. 19

(1883), 149.

41

Verhandlungen, Mitteilungen und Berichte des Centralverbandes Deutscher Industrieller, no. 28

(1884), 34.

42

L. Francke, “Die Stimmen der Deutschen Handels- und Gewerbekammern über das Haftpflicht-

gesetz vom 7. Juni 1871 und den Reichs-Unfallsversicherungs-Gesetzentwurf vom 8.3.1881,”

Zeitschrift des Königlich-Preussischen Statistischen Büros 21 ( ).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 246

than half of the chambers of commerce in the sample continued to ex-

press concerns about the costs of the new social policy.

43

Several pro-

ducers argued that “the consequences of the new social insurance

legislation were incalculable and highly dangerous” and that the law

weakened German industry vis-à-vis foreign competitors.

44

In France

chambers of commerce representing predominantly small firms also

opposed the new social insurance, fearing an increase in their nonwage

labor costs. As an association of employers formulated these worries,

“By preoccupying itself with the situation of workers, the draft bill ne-

glects the numerous and interesting class of employers who will not be

able to afford these costs and will succumb as victims to the new in-

curred responsibility.”

45

Other producers wrote: “We beseech the law-

maker not to inflict a new charge on French industry, on our large and

small enterprises, so courageous in their fight against foreign competi-

tion....A large number of producers will inevitably be crushed by the

impact of a new charge.”

46

The analysis of the social policy preferences expressed by German

and French employers supports the second hypothesis about the cleav-

age between high-risk and low-risk producers. High-risk employers

were in those industries facing a high incidence of workplace acci-

dents—such as iron and steel producers—and in mining and railways.

In Germany the number of accident fatalities (per 100,000 workers) in

these industries was 597 in railways, 261 in mining, 160 in steel pro-

duction, and 125 in construction. By contrast, the number of workplace

accidents in low-risk industries was 18 total in textiles, the paper in-

dustry, and the leather industry and 17 in agriculture.

47

The social pol-

icy preferences of high- and low-risk producers differed dramatically.

In Germany iron and steel producers were the strongest supporters of a

compulsory accident insurance.

48

These employers supported a social

policy solution in which all industries paid similar insurance contribu-

tions, irrespective of the incidence of the risk of workplace accidents.

Employers in high-risk industries also called for a broad and expansive

BUSINESS INTEREST/SOCIAL INSURANCE 247

43

Ibid., 399.

44

Chamber of Commerce Braunsberg, in Francke (fn. 42).

45

Chamber of Commerce of Paris, De la responsabilité des patrons en matière d’accidents, Archive of

the Chamber of Commerce of Paris, III. 5. 60 (1).

46

Chamber of Commerce of Abbeville, Les accidents du travail: Rapport présenté à la chambre de com-

merce d’Abbeville par M. Paillart (Paris: CCP, 1898).

47

Statistics of the period quoted in Florian Tennstedt and Heidi Winter, Quellensammlung zur

Geschichte der Deutschen Sozialpolitik: Von der Haftpflichtgesetzgebung zur ersten Unfallversicherungsvor-

lage (Stuttgart: Gustav Fischer, 1993), 537. There are no similar data available for France. Ironically,

French lawmakers relied on these German statistics during the deliberation of the accident insurance

legislation.

48

Verein Deutscher Eisen- und Stahlindustrieller, “Vorstandssitzung des Vereins Deutscher Eisen

und Stahlindustrieller,” Stahl und Eisen 11 (1884), 177–79.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 247

definition of the risk pool of social insurance, a measure that had the

obvious advantage of lowering their social insurance contributions. In a

letter submitted to the Chamber of Deputies of the French Parliament,

coal producers (Comité Central de Houillières de France) opposed the

intention of lawmakers to limit the scope of accident insurance only to

industries relying on mechanical tools but recommended instead “[ex-

tending] the law to all occupations.”

49

Similarly, German iron and steel

producers pressed arguments for extending social insurance to agricul-

tural workers.

50

In contrast to employers in high-risk industries, employers in indus-

tries facing a lower incidence of workplace accidents opposed proposals

seeking to socialize insurance. In a petition to the Bundesrat, the Fed-

eration of Cotton Employers of Southern Germany (Verein Süd-

deutscher Baumwollindustrieller) expressed the concern that the first

version of the accident insurance legislation under discussion in the

Reichstag placed a disproportionate burden on employers in textiles, as

opposed to iron and steel producers.

51

The peak association represent-

ing German agricultural employers (Deutscher Landwirtschaftsrat)

also worried about the costs attendant on extending social insurance to

agriculture.

52

Similarly, the Society of French Agricultural Employers

(Société des Agriculteurs de France) opposed the intention of lawmak-

ers to enlist agricultural producers as part of the social insurance program,

denouncing these plans as a measure that protected manufacturing pro-

ducers but disfavored agriculture: “The agricultural employers will be

unable to finance social charges that are that heavy. There is no agricul-

tural employer who can provide the necessary capital.”

53

THE DEVELOPMENT OF UNEMPLOYMENT INSURANCE

During the interwar period policymakers in both France and Germany

actively pursued a broad range of social policy reforms. In 1918 Ger-

many reformed its means-tested policy of unemployment assistance in

an effort to cope with the labor-market dislocations of World War I.

The failure of this policy to provide adequate relief to unemployed

workers motivated German labor-market authorities to replace this

248 WORLD POLITICS

49

H. Darcy, La question des accidents du travail devant le Sénat (Paris: Chaix, 1896), 6.

50

See various documents quoted in Tennstedt and Winter (fn. 47), 343–49, 279.

51

Eingabe des Vereins süddeutscher Baumwollindustrieller an den Bundesrat, in Tennstedt and

Winter (fn. 47), 554–56.

52

Denkschrift des Deutschen Landwirtschaftsrates für das Reichsamt des Innern, in Tennstedt and

Winter (fn. 47), 531–38.

53

Michel Augé-Laribé, La politique agricole de la France de 1880 à 1940 (Paris:

PUF, 1950), 113.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 248

policy with a policy of unemployment insurance. In France proposals

to introduce compulsory unemployment insurance were part of more

ambitious proposals to establish compulsory policies of social insurance

covering other risks, such as sickness and old age.

As predicted by the above analysis, in both France and Germany

large manufacturing producers employing high-skilled workers favored

the development of institutions of social insurance that entrusted sig-

nificant administrative responsibilities to employers. In France the as-

sociation that provided the most articulate expression of the concerns

of large, skill-intensive firms was the Union of Metallurgical and Min-

ing Industries (

UIMM), an organization grouping over six thousand

firms in “all industries concerning the production and transformation

of metals.”

54

The

UIMM opposed the proposals of French lawmakers to

unify all preexisting institutions of social insurance under the adminis-

tration of the state, arguing that this policy would create a “hotbed of

public sector employees.” In a report submitted to the Social Policy

Commission of the Chamber of Deputies, these producers pointed out

that the “fundamental error of the project consisted in neglecting the

existing institutions of social insurance which would increase the effec-

tiveness of the law in difficult situations.”

55

Instead of a policy organ-

ized by the state, the

UIMM recommended placing the firm at the

foundation of the institutions of social insurance:

The firm shapes the existence of the worker in crucial ways, by determining the

level of wages, the kinds of risks to which the worker is exposed, by establishing

the strongest bonds of solidarity among workers. It seems natural that the firm

should provide the basis for the organization of social insurance. . . . Enterprises

also facilitate the creation of large autonomous and homogenous insurance

funds for the provision of old-age benefits.

56

The peak association representing large German manufacturing (Verein-

igung der Deutschen Arbeitgebervebände)—an association dominated

by Germany’s dynamic metal-processing sectors—also demanded an

increase in employers’ participation in the new institutions of unem-

ployment insurance and opposed all policy proposals giving trade

unions a majority in the administration of the new social policy.

57

In

contrast, large firms in industries with a lower level of skill intensity—

BUSINESS INTEREST/SOCIAL INSURANCE 249

54

Georges Lefranc, Les organisations patronales en France (Paris: Payot, 1976), 39.

55

UIMM, Déposition devant la commission des assurances et de prévoyance sociale de la Chambre des députés

et le Conseil Supérieur du Travail sur le projet de loi relatif aux assurances sociales, Archive of the Paris

Chamber of Commerce, III. 5. 56 (9), 3.

56

Ibid., 13.

57

Vereinigung der Deutschen Arbeitgeberverbände, Geschäftsbericht der Vereinigung der Deutschen

Arbeitgeberverbände, 1925–1926 (Berlin: VDA, 1927), 136.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 249

such as cement producers or employers in construction—opposed the

introduction of a corporatist compulsory unemployment insurance.

58

While large manufacturing producers demanded either more private-

type social policies or the delegation of higher administrative responsi-

bilities to employers, associations representing small firms expressed

concern about the potential increase in their nonwage labor costs. Out

of a sample of twenty-five chambers of commerce representing small

producers in France, twenty associations opposed the social insurance

project, invoking concerns about a potential increase in their social

charges. Commenting on the social insurance project developed by

French lawmakers, one French chamber of commerce noted that “the

charge on enterprises that will result from the introduction of a contri-

bution totaling 10 percent of the wages will have inevitable repercus-

sion on the price-level of the entire economy....The immediate

introduction of a system of insurance covering all social risks will pro-

voke a profound crisis which will affect the very interests which the new

legislation attempts to protect.”

59

In Germany numerous political associ-

ations representing small manufacturing employers expressed “funda-

mental reservations about the introduction of unemployment insurance,

which creates immense financial burdens for the Reich, Länder, and the

communes.”

60

The two leading associations representing the interests

of small firms opposed the introduction of a policy of unemployment

insurance that “weakened the feeling of responsibility and the striving

for self-reliance and [that] fosters the tendency towards idleness.”

61

The level of the risk of unemployment is a strong predictor of the

variation in the preferences of firms along the risk redistribution di-

mension of the social policy space. In both France and Germany

volatility in employment was highest in manufacturing industries

dependent on export markets, such as metal processing and metal

working.

62

By contrast, agriculture was facing a low incidence of unem-

250 WORLD POLITICS

58

On the opposition of construction employers, see Peter Lewek, Arbeitslosigkeit und Arbeitslosenver-

sicherung in der Weimarer Republik, 1918–1927 (Stuttgart: Franz Steiner, 1992), 157. On the opposition

of cement producers, see Karl Führer, Arbeitslosigkeit und die Entstehung der Arbeitslosenversicherung in

Deutschland, 1902–1927 (Berlin: Colloquim, 1990), 220.

59

Chamber of Commerce of Belfort, Rapport sur le régime des assurances sociales en préparation devant

le Sénat, Archive of the Paris Chamber of Commerce, III. 5. 50 (9).

60

Handelskammer zu Altona, Entwurf eines Gesetzes über eine vorläufige Arbeitslosenver-

sicherung, Zentrales Staatsarchiv Potsdam, Reichswirtschaftsrat, 664.

61

Deutscher Industrie- und Handelstag, Entwurf eines Gesetzes über die Arbeitslosenversicherung,

Zentrales Staatsarchiv Potsdam, Reichsarbeitsamt 4311/87-88; Reichsverband des Deutschen

Handwerks, Beiträge zu den Mitteln der Erwerbslosenfürsorge, Zentrales Staatsarchiv Potsdam,

Reichsarbeitsministerium 1017.

62

For example, average rates of unemployment in Germany were 10.7 in metalworking, as compared

with 0.3 in agriculture. See Drucksachen des Reichstages 2885, 3. Wahlperiode 1926. For France, see

Robert Salais et al., L’invention du chômag (Paris: PUF, 1986).

v55.2.228.mares.cx 3/17/03 1:53 PM Page 250

ployment because “producers in the countryside did not respond to

changes in the demand of their products by laying off workers, but by

adjusting working time.”

63

Beginning in the mid-1920s Germany’s

high-risk producers exercised a dominant political influence within the

Central Association of German Employers’ Federation (Vereinigung

der Deutschen Arbeitgeberverbände). These employers favored “the

expansion of the scope of unemployment insurance legislation” and “the

inclusion of good risks [günstige Risiken] within unemployment in-

surance, in other words, of occupations in which the danger of future

unemployment is lower.”

64

They opposed the differentiation of unem-

ployment insurance contributions based on the incidence of risks faced

by different industries and rejected “the creation of occupational risk

pools [Gefahrenklassen] within unemployment insurance.”

65

In a com-

munication addressed to the Imperial Labor Office in 1920, these em-

ployers argued that it was impossible for industries facing high and

recurrent levels of unemployment to pay higher unemployment insur-

ance contributions, since “the financial existence of these firms is en-

dangered, both as a result of uncertainty in their labor relations and as

a result of an uncertainty in demand. An additional financial burden

that would result from the doubling of the insurance contributions

should not be attempted.”

66

In contrast to these producers, industries facing a low incidence of

unemployment opposed highly redistributive policies of unemployment

insurance. German associations representing agricultural employers op-

posed the proposals of lawmakers to include agriculture as part of un-

employment insurance.

67

Referring to the fact that firms paid wages to

workers even during the winter months, these employers argued that

“the labor market contract of agricultural employees is the best insur-

ance against the risk of unemployment.”

68

In France the two main as-

sociations grouping agricultural producers, the Society of French

Farmers (Société des Agriculteurs de France) and the National Con-

federation of Agricultural Associations (Confédération Nationale des

Associations Agricoles) strongly opposed the plans of French lawmak-

ers to extend social insurance to agricultural producers.

69

They waged a

BUSINESS INTEREST/SOCIAL INSURANCE 251

63

Salais et al. (fn. 62), 35.

64

Vereinigung der Deutschen Arbeitgeberverbände, ed., Geschäftsbericht über das Jahr 1922 (Berlin:

VDA, 1923), 35.

65

Ibid.

66

Vereinigung der Deutschen Arbeitgeberverbände, Denkschrift der VDA an das Reichsarbeitsmin-

isterium 1920, Zentrales Staatsarchiv Potsdam, Reichsarbeitsamt 4310/475.

67

See statements of associations representing agricultural producers quoted in Führer (fn. 58), 324.

68

Ibid., 323.

69

Augé-Laribé (fn. 53), 109–17.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 251

fierce political campaign against the plans—invoking the existence of

strong differences in the character of the employment relationship in

agriculture and industry, such as “the higher presence of remuneration

in kind in agriculture, the reliance of agricultural employers on mem-

bers of their extended family, as well as the strong individualism of the

peasant, which is the result of the profound isolation of work on the

field.” Instead they favored a policy outcome relying on voluntary insti-

tutions of private insurance, such as mutual aid societies (sociétés de

secours mutuels) and agricultural mutual insurance companies (mutuelles

agricoles) for the provision of social policy benefits.

T

HE REORGANIZATION OF SOCIAL INSURANCE DURING THE

POSTWAR

YEARS

Emboldened by the success of the policy reforms in Britain, policy-

makers in France and Germany initiated ambitious proposals for social

policy reform in the first years after World War II. In France an early

bill enacted during the first months of the liberation (Ordonnance of

October 1945) proposed unifying the administration of all subsystems

of the welfare state. Additional proposals for reform taken up by the

French parliament during the following months recommended the in-

troduction of a universalistic social policy. Military authorities govern-

ing Germany also considered proposals to introduce universalistic social

insurance. These reforms involved far-reaching changes to the “Bis-

marckian” setup of the welfare state of both countries.

The first important policy change recommended by these new leg-

islative proposals increased the role of the state and labor representa-

tives in the administration of social insurance. These policy

recommendations met with strong opposition from German and

French employers. In Germany the peak association representing large

manufacturing employers defended the importance of “parity represen-

tation” of labor and capital in the administration of social insurance as

the only solution that could “avoid the concentration of economic

power of one group over another.”

70

In a policy paper entitled, The

Economy and the German Social Insurance, manufacturing employers ar-

gued that the administration of social insurance by individual firms or

associations of employers had been historically successful in containing

the growth of social insurance contributions.

252 WORLD POLITICS

70

Vereinigung der Arbeitgeberverbände, Rundschreiben an den Bundesarbeitsminister Storch betreffend

der Selbstverwaltung in der Sozialversicherung, November 29, 1949, BDA Archive, Cologne.

v55.2.228.mares.cx 3/17/03 1:53 PM Page 252

Institutions of sickness insurance organized at the firm level [Betrieb-

skrankenkassen], as well as the liability associations [Berufsgenossenschaften], de-

termine the level of insurance contributions and reserves based on the risk

profile of the firm, which is influenced by the accident-proneness and sickness

of the workforce.This has a strong effect on the level of social insurance contri-